Suzuki Burgman Street 125cc meluncur di Delhi Auto Expo,

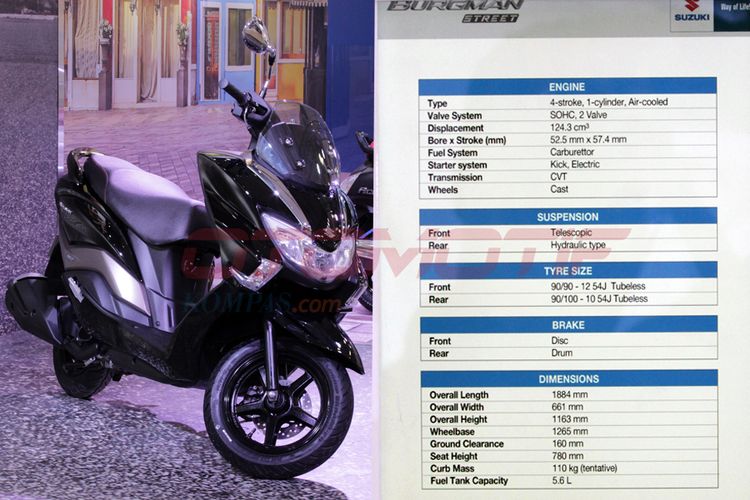

New Delhi – Suzuki Motorcycle India Private Limited baru saja meluncurkan model anyar Burgman Street dengan mesin 125cc di Delhi Auto Show 2018. Skutik maxi itu memiliki kapasitas mesin paling kecil di antara model global Burgman lainnya.

Di global, Burgman punya pilihan mesin 650cc, 400cc, dan model yang pernah dijual di Indonesia, 200cc. Mesin Burgman Street 125cc sama seperti model Suzuki paling laris di India, Access 125.

Menariknya, Burgman Street merupakan skutik maxi pertama di India. Di stan Honda, konsep PCX yang debut di Tokyo Motor Show baru dipamerkan. Burgman Street memiliki berbagai fitur unggulan seperti lampu depan LED, pijakan kaki selonjoran, dan tameng angin di depan. Bodinya yang gambot ditopang suspensi telescopic di depan dan monoshock tipe swingarm di belakang.

Suzuki Burgman Street 125cc meluncur di Delhi Auto Expo, Rabu (7/2/2018). Lampu depan sudah LED, namun masih menggunakan teknologi karburator.

Keuntungan bodi besar Burgman Street yaitu memiliki bagasi berkapasitas tujuh liter yang terbagi menjadi dua kompartemen di depan. Salah satu kompartemen bisa dikunci dan mempunyai soket carjer 12V.

Sesuai modelnya berupa skutik maxi, Burgman Street bisa dibawa touring jauh sebab kapasitas tangki bahan bakarnya 10.5 liter. Bobot keseluruhan 110 kg, rem cakram di depan, pelek 14 inci.

Burgman Street menggendong mesin 1-silinder 124cc yang menghasilkan tenaga 10,7 tk dan torsi 10 Nm ke roda via CVT. Namun mesin itu masih berteknologi karburator. Suzuki mengklaim efisiensi bahan bakarnya mencapai 40 kpl.

Rumors yang menyebar di Delhi Auto Show, Burgman bakal punya pilihan mesin 150cc. Model yang satu itu bisa jadi cocok untuk Indonesia buat membuka pertarungan bersama model sukses Yamaha NMAX dan pesaingnya Honda PCX.

Source : otomotif.kompas.com

What Is CFD Trading, Introduce To CFD Trading

Cfd trading is a cfd derivative contract trading (contract for difference) between two parties commonly referred to as the buyer and the seller. they will pay the difference between the purchase price and the selling price of some financial instruments such as stocks, commodities, currencies and indices. in essence, cfd trading shows products and trading services that allow you to trade on the market through a broker make an asset without having the asset instruments contained in the contract. For example If you do the action "buy" cfd trading in oil commodities, then not really - really buy oil.

Trading cfd

The purpose of cfd trading

There are several reasons why people decide to do cfd trading activities. here are some of them:Able to earn profit from buy or sell

Cfd trading allows the trader to determine the position of buy, if the trader believes that the price when in the market will rise, or set the position sell, If it is believed the price of assets in the market Will fall.If a trader believes that a company or market will experience a decline in the short term, the trader can use the cfd to sell the asset today and profit will still be able to be generated even if the asset price in the market is declining. therefore, cfd trading is a flexible trading alternative because it allows traders to profit from convoys of up and down prices. Although, when price movements on the market are not the same as using Prediction, then traders can still experience loss.

Protection against investment portfolio

If someone is worried about his investment portfolio when this will decrease in value, then he is able to use cfd trading to cover loss by reaching the selling action step. thus, the loss due to impairment of assets in the portfolio can be reduced by the profit derived from the sell position in cfd trading. This time, there are a variety of investors who are already utilizing cfdTrading to protect their assets, especially when price volatility in financial markets is high and risky.Cfd trading

How does cfd trading work?

Actually the way cfd trading means almost similar to using investment activity in other financial markets. being an example in stock cfd, you decide to invest in stock x company by buying 100 shares at usd25.26 price. the total cost that must be spewed means usd2,526. but on cfd trading, you can trade with margin, so do not have to spend that much money. for example, your broker shows trading with a margin of 5 percent, you can buy these shares with funds usd126.30 only. when after a few hours later the purchase price of this share rises to the price level usd25.76, the stock can be sold for profit as much as usd50.However, the bid price of CFD may be only 25.74 because the amount of spread in cfd is generally greater than the actual stock market (spreads here become the broker's profit brokering cfd trading), as a result there can be a difference of a few cents in profit. therefore, the profit from the stock trading cfd may only be less than usd46 and usd48 only. in this case, it is known that spreads in cfd trading limit the profit traders can get.

Excess cfd trading

Trading by margin

Cfd trading provides a much higher margin facility than the stock market or a real commodity market. Minimum margin requirements on the CFD market are ranging from two percent. the margin requirement depends on the traded asset, for example on the stock cfd, the margin requirement can be up to 20%. lower margin requirements make the capital required trader or investor is reduced, so the potential for receiving a bigger profit. However, it should also be remembered that trading using margins presents a higher risk.Access Global market from one platform

Some great brokers cfd trading providers show a wide range of products that are traded on primary markets in the global, including from American societies, English, europe, and others. this provides that traders can practically trade in many markets using just one platform. in addition, the cfd market generally does not have any specific rules relating to selling, because an instrument can be sold and purchased at any time. Professional order penalties without additional portoCfd brokers show many types of similar orders in regular brokers ie stop orders, limit orders and one-cancels-the-other (oco) orders. In addition, most brokers do not charge commission portos or other fees when a trader enters or exits the market. brokers earn profit from the spread is the difference between the bid price (bid) and the purchase price (ask). spreads can be small as well as large, great depending on price volatility on the market when that.

Reductions and risks in cfd trading

Although it looks very interesting, cfd trading still has some drawbacks. the spread in the entry and exit may reduce the profitability of the impact of the difference in price convoy is thinning. besides, there are also some risks that stick to cfd trading.The risk of cfd trading

Market risk

The main risk in cfd trading is market risk because the contract on cfd is made to pay the difference between the opening price and the closing price of the particular asset. cfd is traded using margin, thus allowing traders to make use of small capital in reaching risky positions. the existence of margin aka high leverage facility is very dangerous and potentially big cause trader experience loss more from capital that owned, If market movement not sync using prediction. one way to reduce this risk means by using stop loss and apply money management.Risiko brokerA broker means a company that provides assets in financial transactions. when buying and selling cfd, the sole asset being traded is a contract issued by the broker. therefore, make sure to choose the right broker, which has a clear regulatory status and not a ruse.

Cfd trading can provide a good alternative for traders, both short and long term traders. however, every trader who goes to the Cfd Market is also obliged to weigh the advantages and disadvantages. In addition, it is also important to establish a trading plan, because trading using targeted planning will be able to generate a permanent trader in the market using consistent trading results.

Source aboutforex